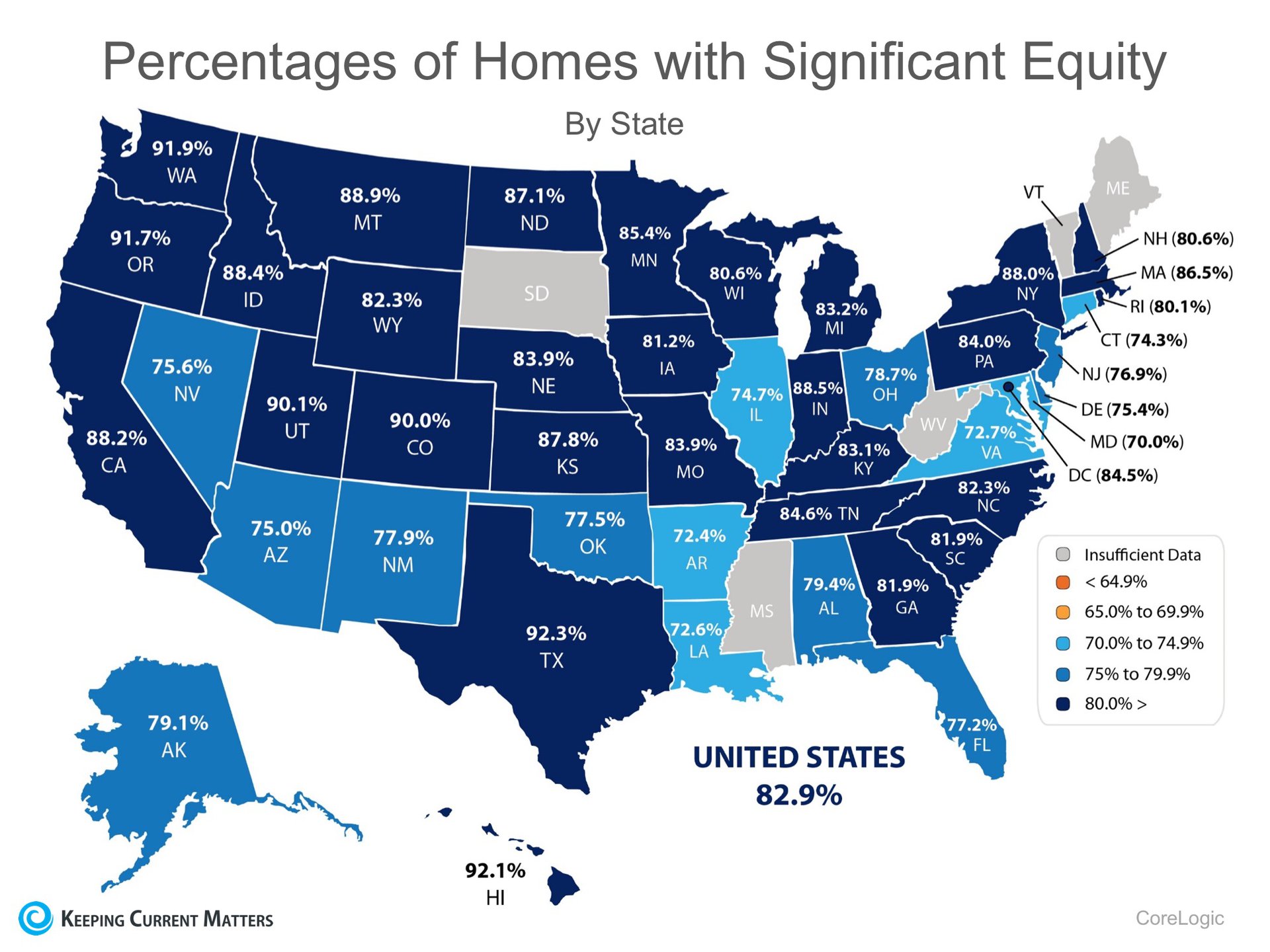

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret in order to buy that home!

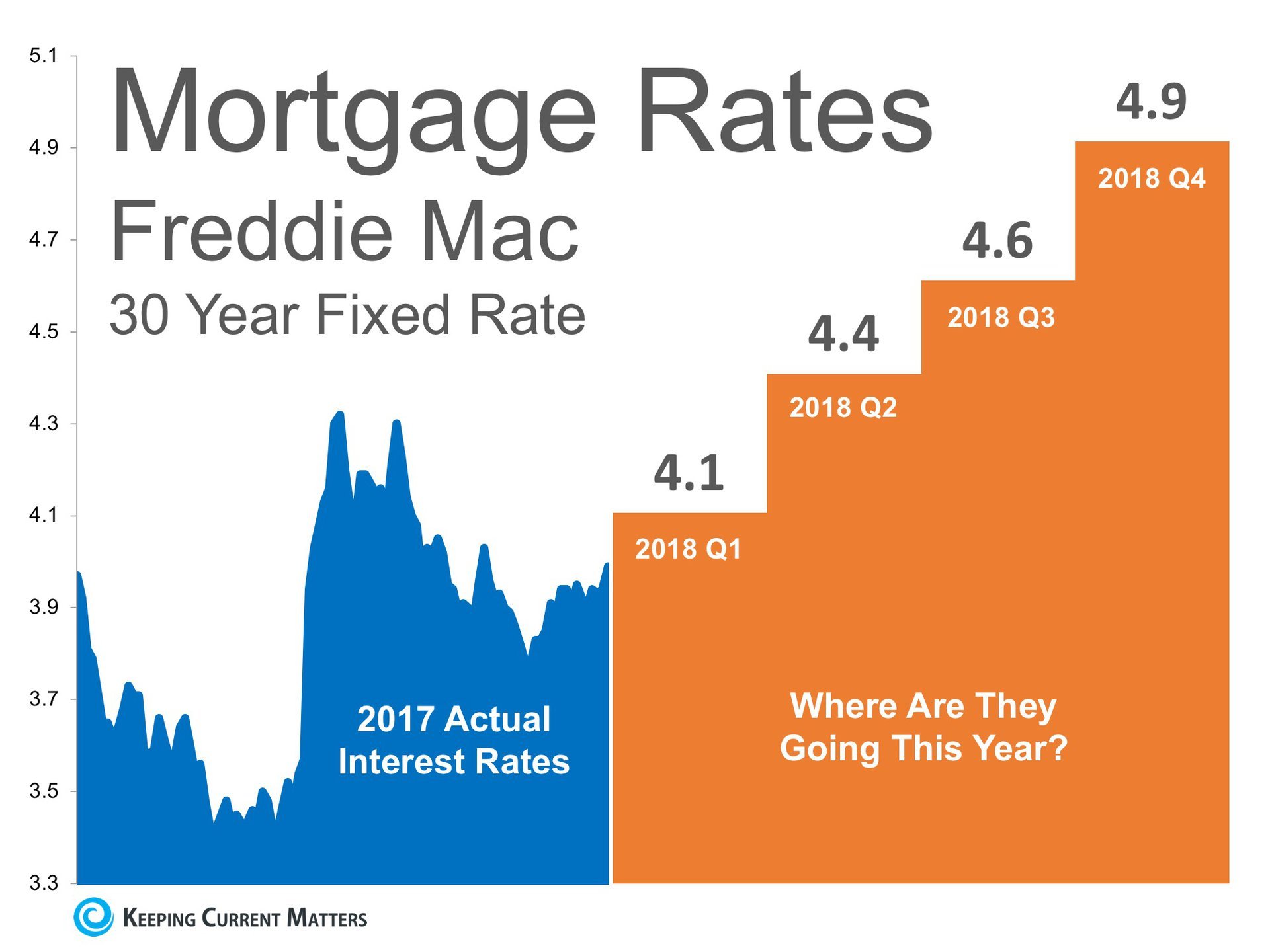

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one. Meet with Stovall Team today to evaluate your ability to purchase a home. CALL TODAY 714.343.9294 and VISIT StovallTeam.com!!

The #1 Reason To Sell Now Before Spring

The price of any item (including residential real estate) is determined by ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increases every spring. As an example, here is what happened to housing inventory at the beginning of 2017:

Putting your home on the market now instead of waiting for increased competition in the spring might make a lot of sense. Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.