We often talk about why it makes financial sense to buy a home, but more often than not, the emotional reasons are the more powerful or compelling ones. No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it’s a certain scent or a favorite chair, the emotional reasons why we choose to buy our own homes are typically more important to us than the financial ones.

1. Owning your home offers you the stability to start and raise a family

Between the best neighborhoods and the best school districts, even buyers without children at the time of purchase may have these things in mind as major reasons for choosing the locations of the homes that they purchase.

2. There’s no place like home

Owning your own home offers you not only safety and security, but also a comfortable place that allows you to relax after a long day!

3. You have more space for you and your family

Whether your family is expanding, an older family member is moving in, or you need to have a large backyard for your pets, you can take this all into consideration when buying your dream home!

4. You have control over renovations, updates, and style

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Tired of paying an additional pet deposit in your apartment building? Or maybe you want to finally adopt that puppy or kitten you’ve seen online 100 times? Who’s to say that you can’t do just that in your own home?

Whether you are a first-time homebuyer or a move-up buyer who wants to start a new chapter in your life, now is a great time to reflect on the intangible factors that make a house a home. Demand is strong in the starter and trade-up home market which means that most homes listed for sale are selling quickly. Our intimate knowledge of the communities and schools enables Stovall Team to guide clients as sellers and create strategic marketing campaigns to sell your home quickly and for top dollar. The Stovall Team’s passion for real estate teamed with savvy negotiating skills and utmost devotion to clients is second to none. If you are planning on selling your home, call and set a time to meet with the Stovall Team today to evaluate the opportunities in your market. Call the Stovall Team today at 714.343.9294! We are here to invest in your family’s future with you. At Stovall Team we are focused on helping you understand the process while helping you find your dream home.

+

+

The #1 Reason To List Your House For Sale NOW!

If you are debating whether or not to list your house for sale this year, here is the #1 reason not to wait!

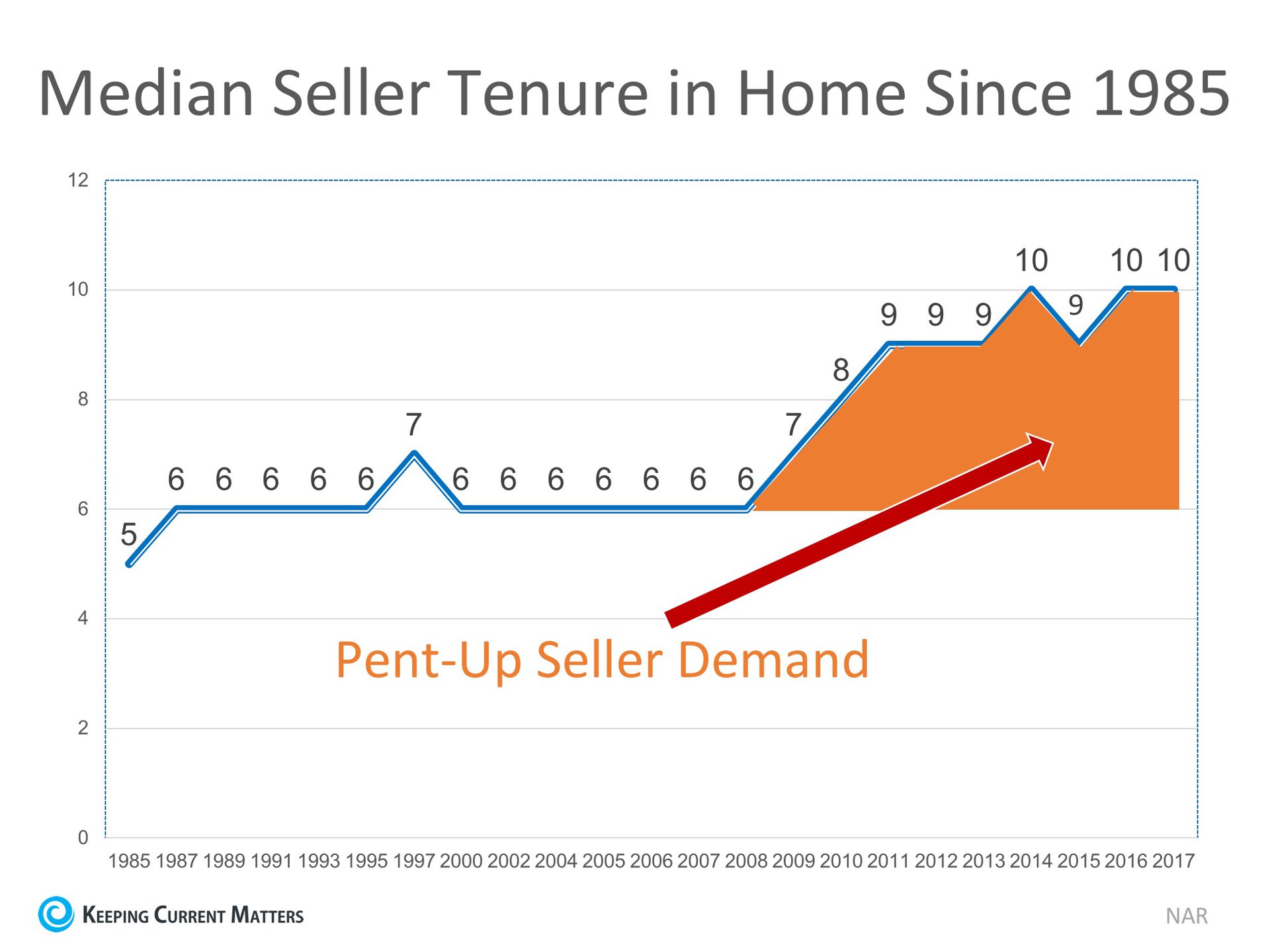

Buyer Demand Continues to Outpace the Supply of Homes for Sale

The National Association of Realtors’ (NAR) Chief Economist Lawrence Yun recently commented on the current lack of inventory:

The latest Existing Home Sales Report shows that there is currently a 4.1-month supply of homes for sale. This remains lower than the 6-month supply necessary for a normal market, and 6.1% lower than last year’s inventory level.

The chart below details the year-over-year inventory shortages experienced over the last 12 months:

Anything less than a six-month supply is considered a “seller’s market.”

Bottom Line

Meet with Stovall Team and we can show you the supply conditions in your neighborhood and assist you in gaining access to the buyers who are ready, willing, and able to buy right now!

In today’s competitive atmosphere, you need a professional on your side who not only knows the exact conditions in your market but can also help you take the steps you need to in order to secure your new home! Now, more than ever, who you work with matters! Our primary goal is to deliver the highest level of service available to each and every one of our clients. We strive to make each of our listings the best they can be. We are always willing to go the extra mile for our clients. Call the Stovall Team today reached at 714.343.9294 Visit stovallteam.com