Some are attempting to compare the current housing market to the market leading up to the “boom and bust” that we experienced a decade ago. They look at price appreciation and conclude that we are on a similar trajectory, speeding toward another housing crisis.

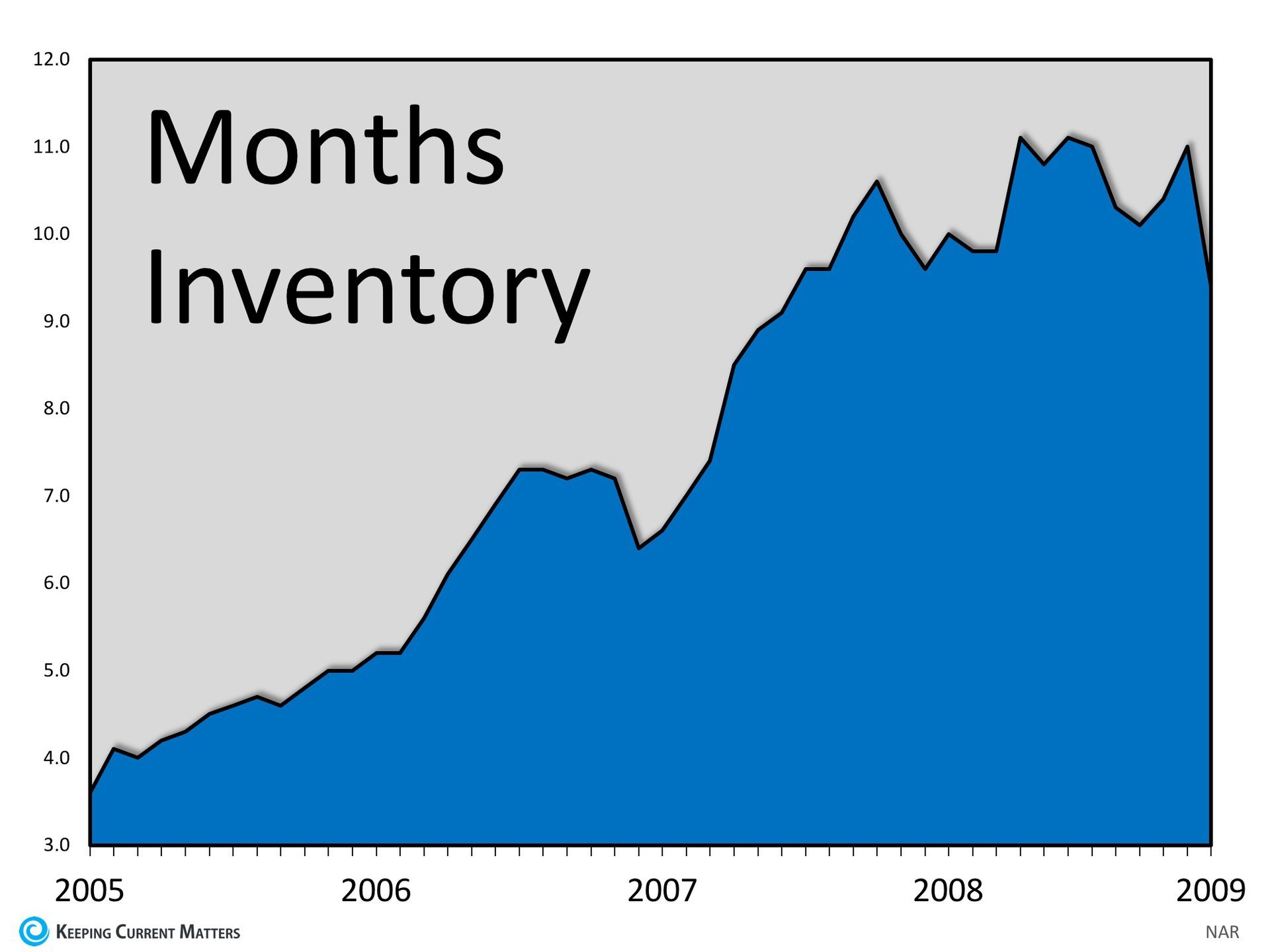

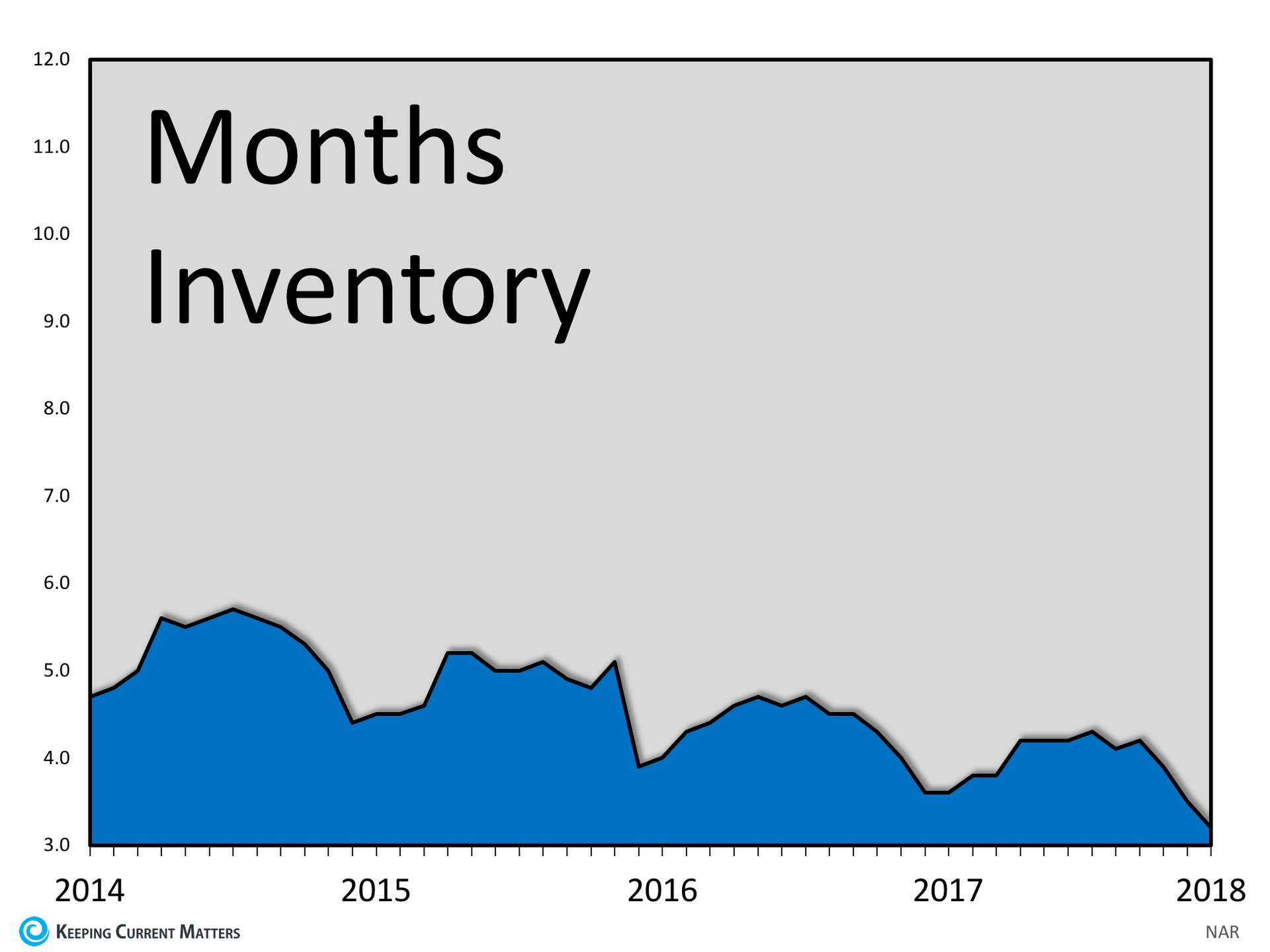

However, there is a major difference between the two markets. Last decade, while demand was being artificially created by extremely loose lending standards, a tremendous amount of inventory was coming to the market to satisfy that demand. Below is a graph of the inventory of homes available for sale leading up to the 2008 crash.

A normal market should have approximately 6 months supply of housing inventory. As we can see, that number jumped to over 11 months supply leading up to the housing crisis. When questionable mortgage practices ceased, and demand dried up, there was a glut of inventory on the market which caused prices to drop as there was too much supply and not enough demand.

Today is radically different!

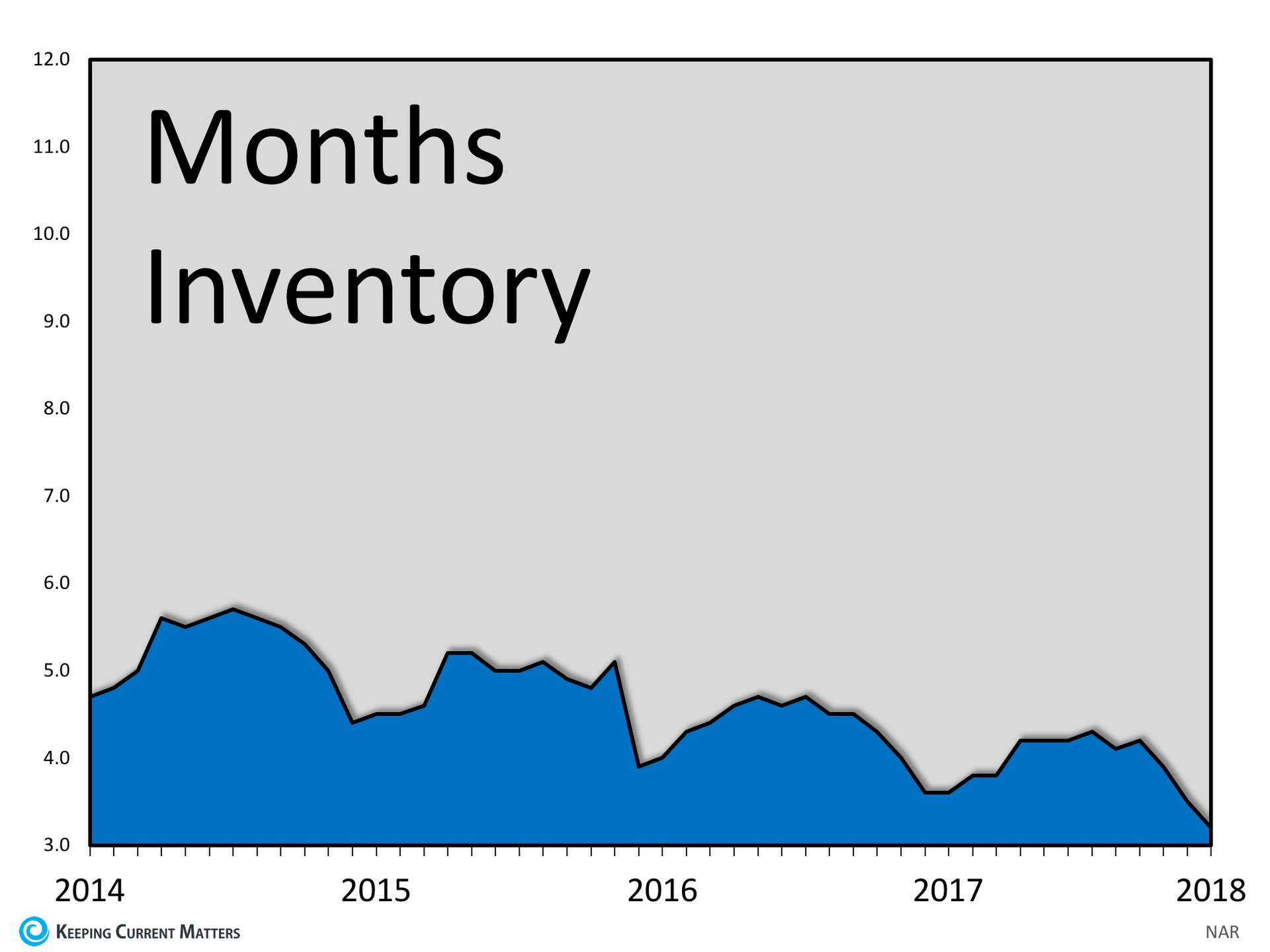

There are those who believe that low mortgage rates have created an artificial demand in the current market. They fear that if mortgage rates continue to rise, some of the current demand will dry up (which is a possibility).

However, if we look at supply again, we can see that the current supply of homes is well below the norm of 6 months.

Bottom Line

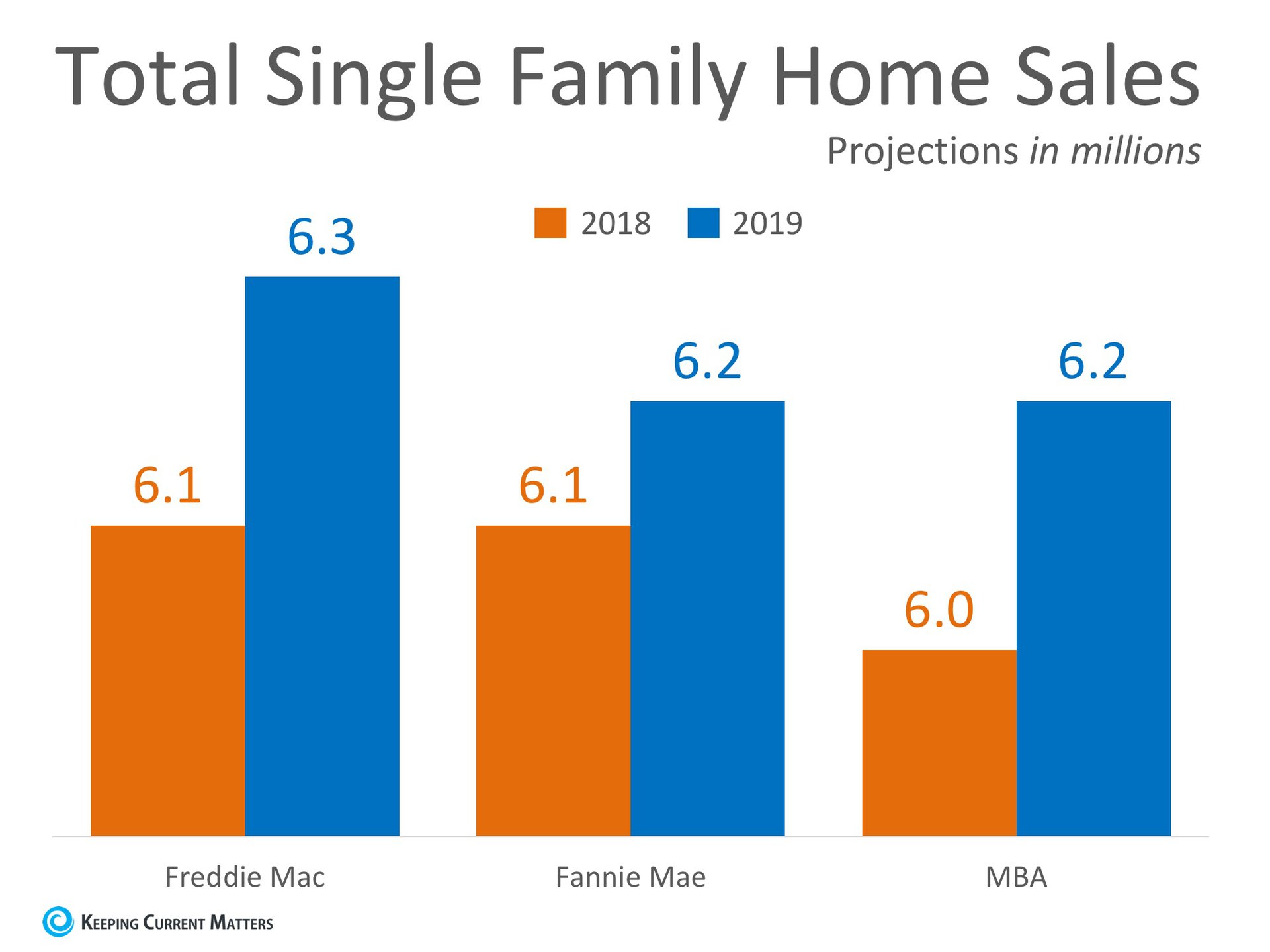

We will not have a glut of inventory like we did back in 2008 and home values won’t come tumbling down. Instead, if demand weakens, we will return to a normal market (approximately a 6-month supply) with historic levels of appreciation (3.6% annually).

Meet with Stovall Team and we can show you the supply conditions in your neighborhood and assist you in gaining access to the buyers who are ready, willing, and able to buy right now! In today’s competitive atmosphere, you need a professional on your side who not only knows the exact conditions in your market but can also help you take the steps you need to in order to secure your new home! Now, more than ever, who you work with matters! Our primary goal is to deliver the highest level of service available to each and every one of our clients. We strive to make each of our listings the best they can be. We are always willing to go the extra mile for our clients. Call the Stovall Team today reached at 714.343.9294 Visit stovallteam.com

5 Real Estate Reality TV Myths Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV or Bravo TV Real Estate Reality Show binge session? We’ve all been there, watching entire seasons of “Love it or List it,” “Million Dollar Listing,” “House Hunters,” “Property Brothers,” and so many more all in one sitting.

When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Reality TV Show Myths vs. Real Life:

Myth #1: Buyers look at 3 homes and decide to purchase one of them.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors the average homebuyer tours 10 homes as a part of their search.

Myth #2: The houses the buyers are touring are still for sale.

Truth: Everything is staged for TV. Many of the homes being shown are already sold and are off the market.

Myth #3: The buyers haven’t made a purchase decision yet.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Myth #4: If you list your home for sale, it will ALWAYS sell at the open house.

Truth: Of course, this would be great! Open houses are important to guarantee the most exposure to buyers in your area but are only a PIECE of the overall marketing of your home. Keep in mind that many homes are sold during regular showing appointments as well.

Myth #5: Homeowners decide to sell their homes after a 5-minute conversation.

Truth: Similar to the buyers portrayed on the shows, many of the sellers have already spent hours deliberating the decision to list their homes and move on with their lives/goals.

Working with the Stovall Team ensures you have experienced professionals on your side while navigating the real estate market and is the best way to guarantee that you make the home of your dreams a reality! Call us today 714.343.9294.