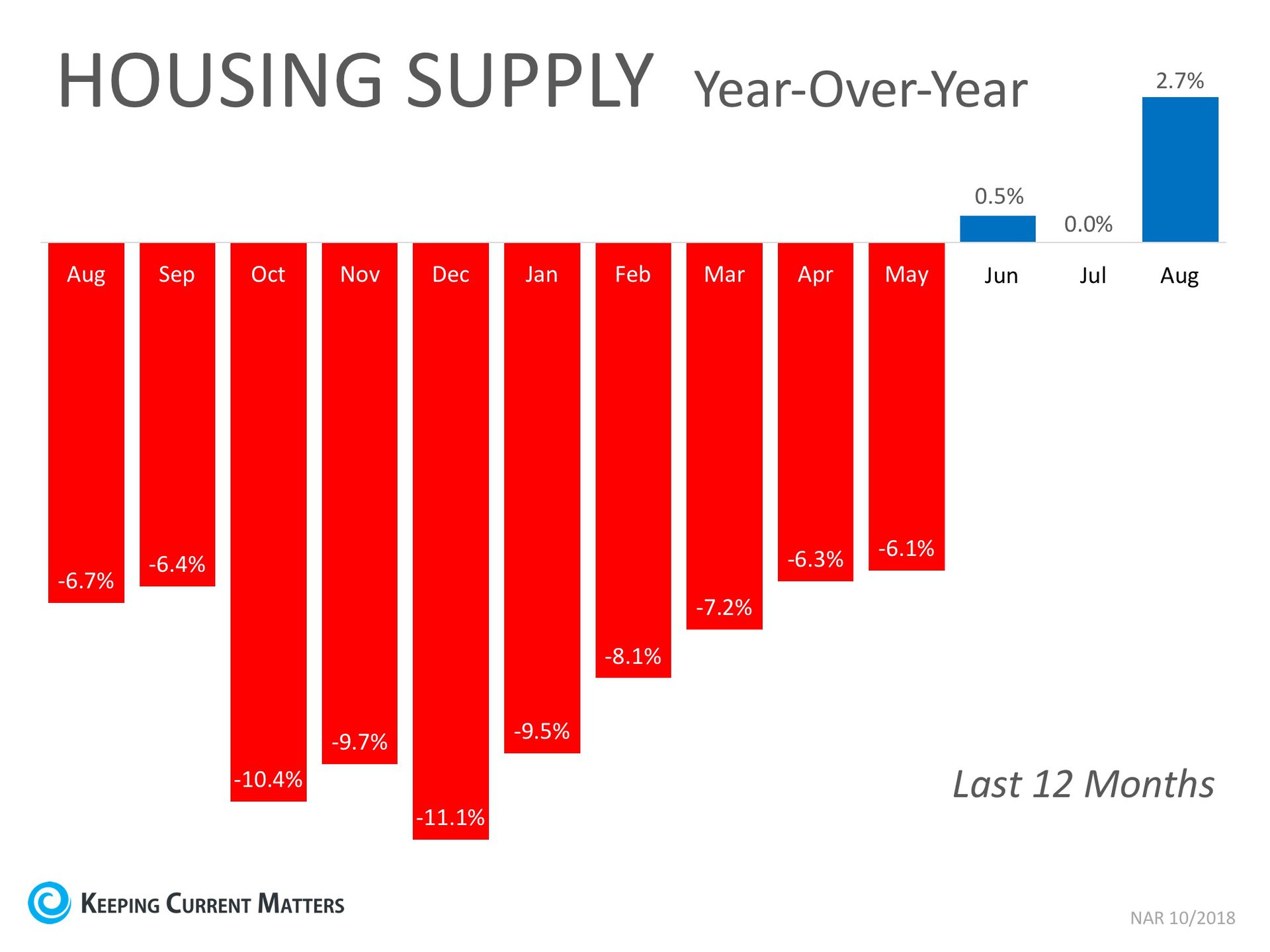

In today’s real estate market, with low inventory dominating the conversation in many areas of the country, it can often be frustrating to be a first-time homebuyer if you aren’t prepared.

In a recent realtor.com article entitled, “How to Find Your Dream Home—Without Losing Your Mind,” the author highlights some steps that first-time homebuyers can take to help carry their excitement of buying a home throughout the whole process.

1. Get Pre-Approved for a Mortgage Before You Start Your Search

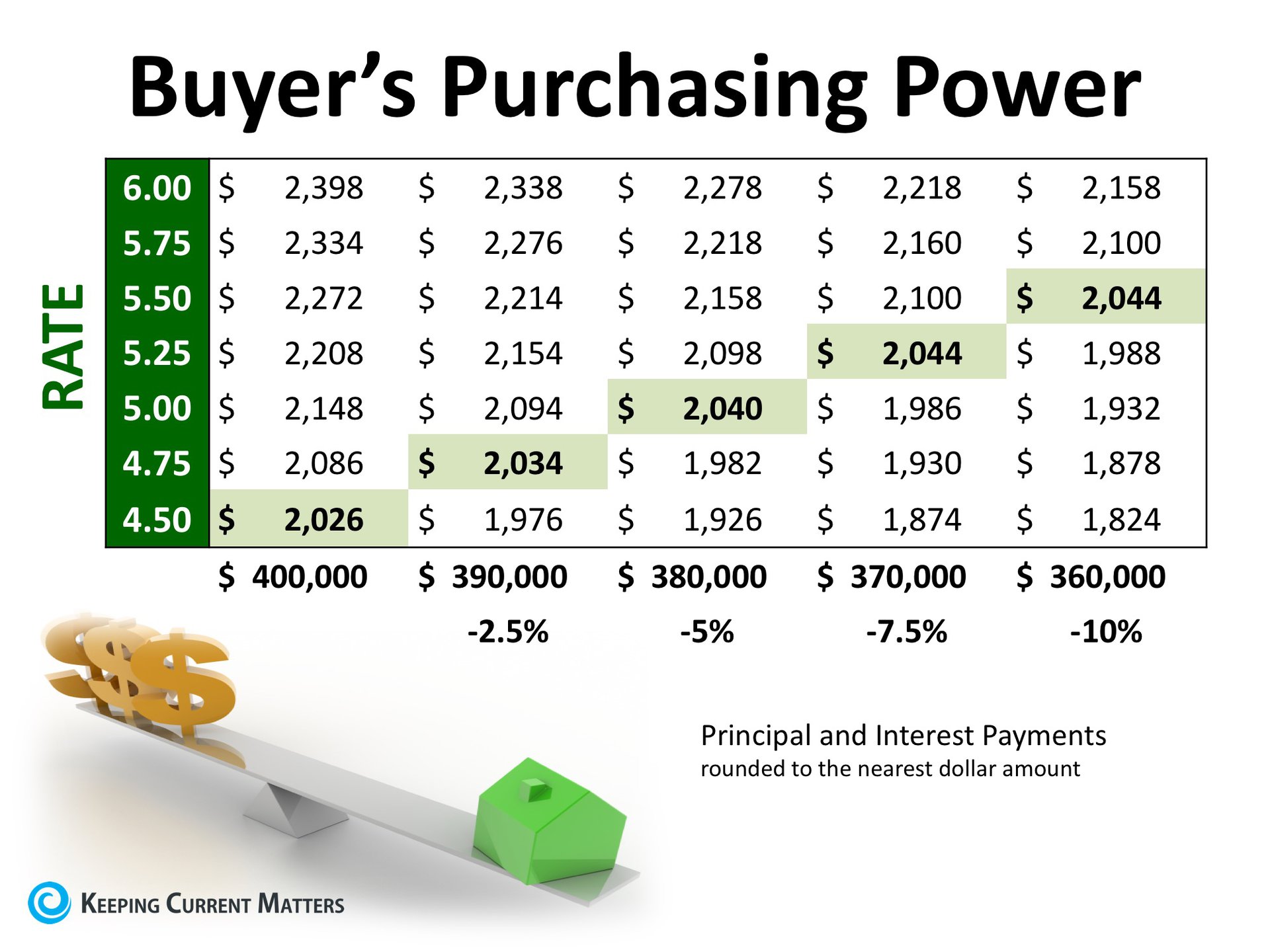

One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach.

This step will also help you narrow your search based on your budget and won’t leave you disappointed if the home you tour, and love, ends up being outside your budget!

2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

Before you start your search, list all the features of a home you would like and then qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help keep you focused on what’s most important.

3. Research and Choose a Neighborhood You Want to Live In

Every neighborhood has its own charm. Before you commit to a home based solely on the house itself, the article suggests test-driving the area. Make sure that the area meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

4. Pick a House Style You Love and Stick to It

Evaluate your family’s needs and settle on a style of home that would best serve those needs. Just because you’ve narrowed your search to a zip code, doesn’t mean that you need to tour every listing in that zip code.

An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

5. Document Your Home Visits

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy and documenting what you love and don’t love about each property you visit. They even go as far as to suggest snapping a photo of the ‘for sale’ sign on the way into the property to help keep the listings divided in your photo gallery.

Making notes on the listing sheet as you tour the property will also help you remember what the photos mean, or what you were feeling while touring the home.

Bottom Line

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home. Call the Stovall Team today at 714.343.9294 and we can help make your dreams a reality.

Buying a Home Can Be Scary…Until You Know the Facts