There are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million people in the U.S. became instantly unemployed when it was determined that the only way to defeat this horrific virus was to shut down businesses across the nation. One second a person was gainfully employed, a switch was turned, and then the room went dark on their livelihood.

The financial pain so many families are facing right now is deep.

How deep will the pain cut?

Major institutions are forecasting unemployment rates last seen during the Great Depression. Here are a few projections:

- Goldman Sachs – 15%

- Merrill Lynch – 10.6%

- Wells Fargo – 7.3%

How long will the pain last?

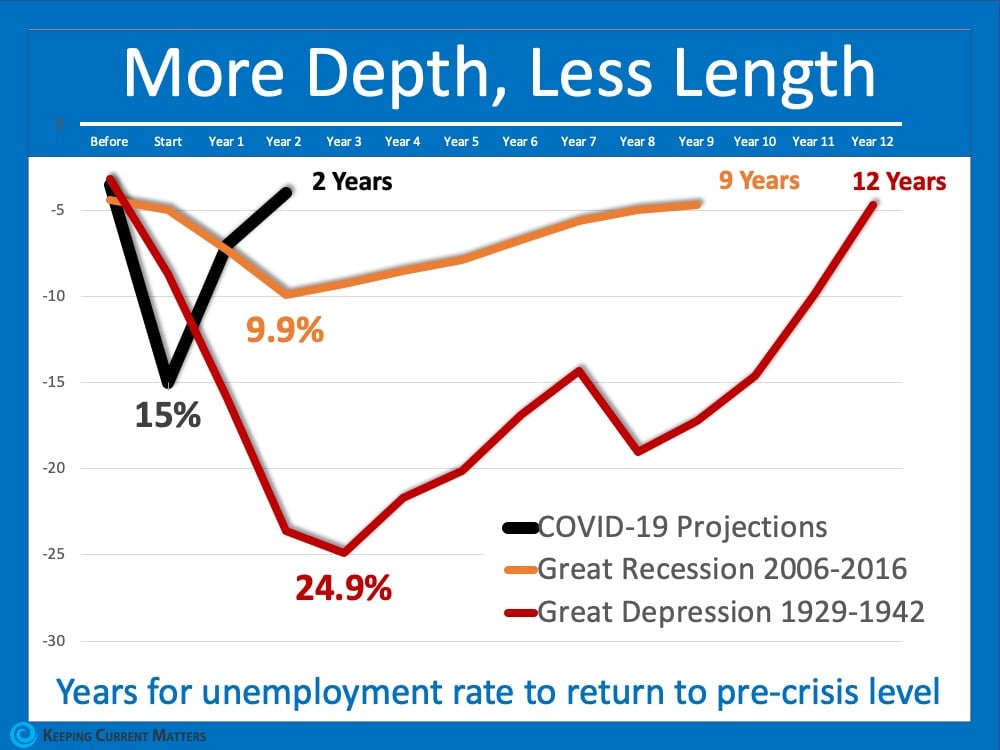

As horrific as those numbers are, there is some good news. The pain will be deep, but it won’t last as long as it did after previous crises. Taking the direst projection from Goldman Sachs, we can see that 15% unemployment quickly drops to 6-8% as we head into next year, continues to drop, and then returns to about 4% in 2023.

When we compare that to the length of time it took to get back to work during both the Great Recession (9 years long) and the Great Depression (12 years long), we can see how the current timetable is much more favorable.

Bottom Line

It’s devastating to think about how the financial heartache families are going through right now is adding to the uncertainty surrounding their health as well. Hopefully, we will soon have the virus contained and then we will, slowly and safely, return to work.

What Impact Might COVID-19 Have on Home Values?

A big challenge facing the housing industry is determining what impact the current pandemic may have on home values. Some buyers are hoping for major price reductions because the health crisis is straining the economy. The price of any item, however, is determined by supply and demand, which is how many items are available in relation to how many consumers want to buy that item.

In residential real estate, the measurement used to decipher that ratio is called months supply of inventory. A normal market would have 6-7 months of inventory. Anything over seven months would be considered a buyers’ market, with downward pressure on prices. Anything under six months would indicate a sellers’ market, which would put upward pressure on prices. Going into March of this year, the supply stood at three months – a strong seller’s market. While buyer demand has decreased rather dramatically during the pandemic, the number of homes on the market has also decreased. Locally we currently have approximately 3.4 months of inventory. This means homes should maintain their value during the pandemic.

This information is consistent with the research completed by John Burns Real Estate Consulting, which recently reported:

What are the experts saying?

Here’s a look at what some experts recently reported on the matter:

Ivy Zelman, President, Zelman & Associates

Freddie Mac

Mark Fleming, Chief Economist, First American

Bottom Line

Even though the economy has been placed on pause, it appears home prices will remain steady throughout the pandemic. I am closely watching the housing market locally, nationally, and internationally. Call me if you have any questions or want to discuss your real estate options. 714.343.9294