You may have heard that the housing market is softening. There is no doubt that buyer traffic has decreased. There are fewer purchasers in the market than there were last month and at this time last year. What you may not have heard, however, is that there is still a severe shortage of listing inventory in many regions of the country.

In a recent interview discussing the housing market, First American’s Chief Economist Mark Fleming put it simply:

“The biggest challenge is really the availability of supply.”

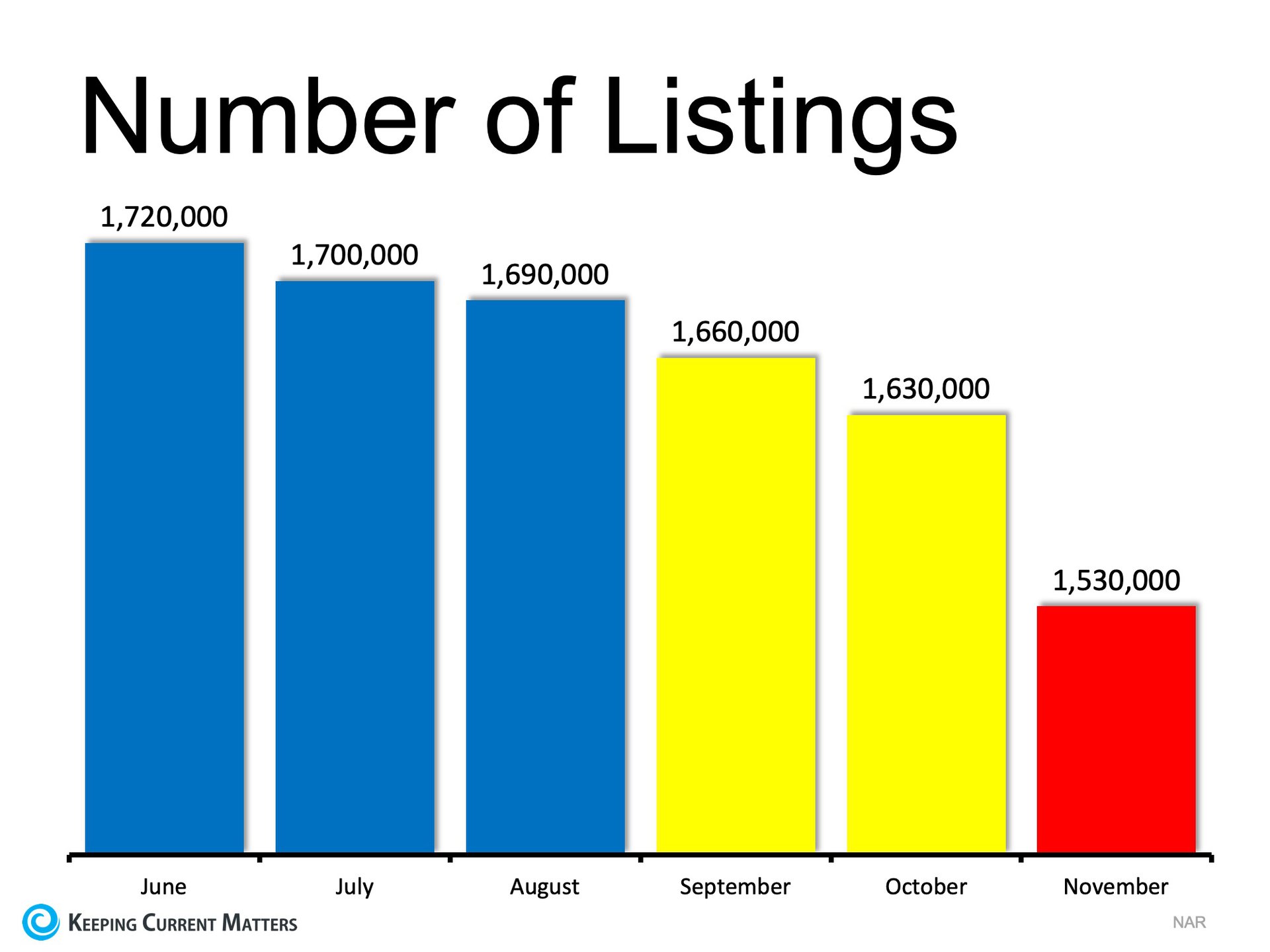

When we look at available inventory numbers released by the National Association of Realtors (NAR), we see that the actual number of homes for sale has decreased in each of the last five months.

What does this mean to you as a seller?

The best time to sell is when there is less competition. That guarantees you a better price and fewer hassles in the transaction.

Bottom Line

If you are thinking of selling your house this year, the best time to put it on the market might be right now. Let’s sit down together to see whether that is true in your neighborhood. Call me at 714.343.9294.

Buying A Home Young Is The Key To Building Wealth

Homeowners who purchase their homes before the age of 35 are better prepared for retirement at age 60, according to a new Urban Institute study. The organization surveyed adults who turned 60 or 61 between 2003 and 2015 for their data set.

The full breakdown is in the chart below:

The study goes on to show the impact of purchasing a home at an early age. Those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-twenties and early-30s had close to $50,000 left, but traditionally had purchased more expensive homes.

Many housing experts are concerned that the homeownership rate amongst millennials, those 18-34, is much lower than previous generations in the same age range. The study results gave a great reason why this generation should consider buying instead of signing a renewal on their lease:

Bottom Line

If you are one of the many young people debating whether buying a home this year is right for you, sit with Stovall Team and we can help. Call us today at 714.343.9294.