With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

Is it worth it?

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Bottom Line

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, I know the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day. Call me today at 714.343.9294 or email [email protected]

Honest Hope During this Time

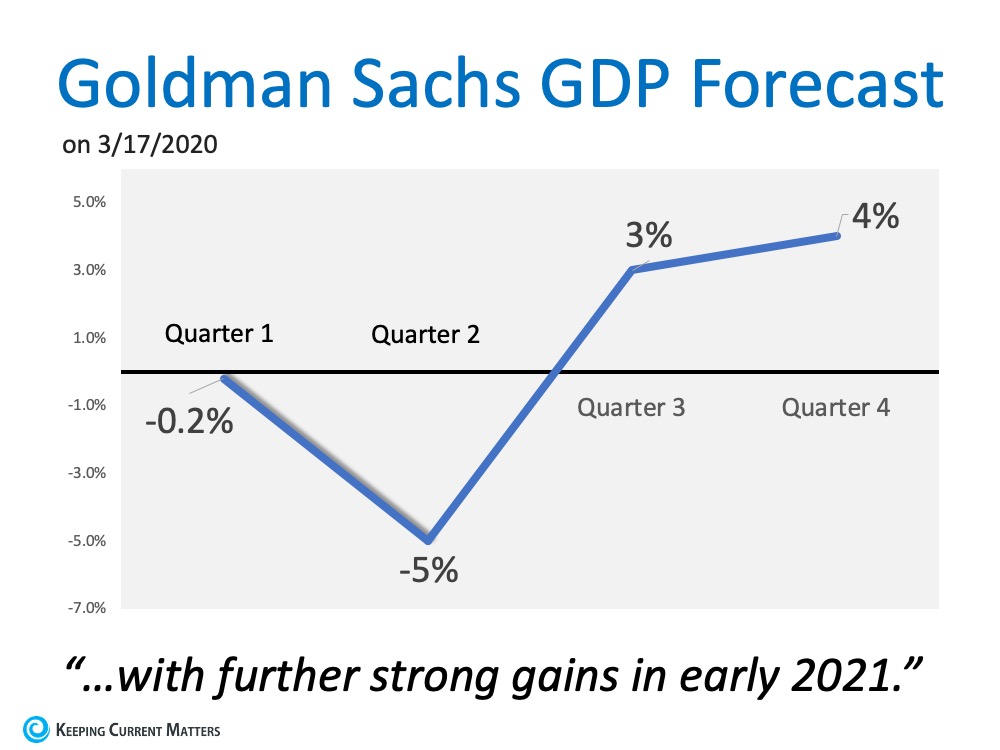

This might take a while. Let’s focus on what we know today. The real estate market locally is strong right now. There is no doubt the country hasn’t seen job losses this quickly in almost one hundred years. How bad could it get? Goldman Sachs projects the unemployment rate to be 15% in the third quarter of 2020, flattening to single digits by the fourth quarter of this year, and then just over 6% percent by the fourth quarter of 2021. Not ideal for the housing industry, but manageable.

Our focus is on taking the next right step, which means the following:

Part of our commitment to you means that we are no longer passing out our monthly newsletter in person. We have decided to mail the Stovall Team’s Monthly Insight for the month of April and may continue into the future. We are following strict CDC protocol to help reduce the spread of COVID-19 for our community and family of buyers and sellers. We really miss seeing your faces (in real life) and chatting with you but at this time we want to keep your family safe and healthy. If you have questions, please call 714.343.9294 and visit stovallteam.com.

Things will be different in the future but it can still be good.