You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So, if you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home, like the down payment and closing costs. And here’s the best part.

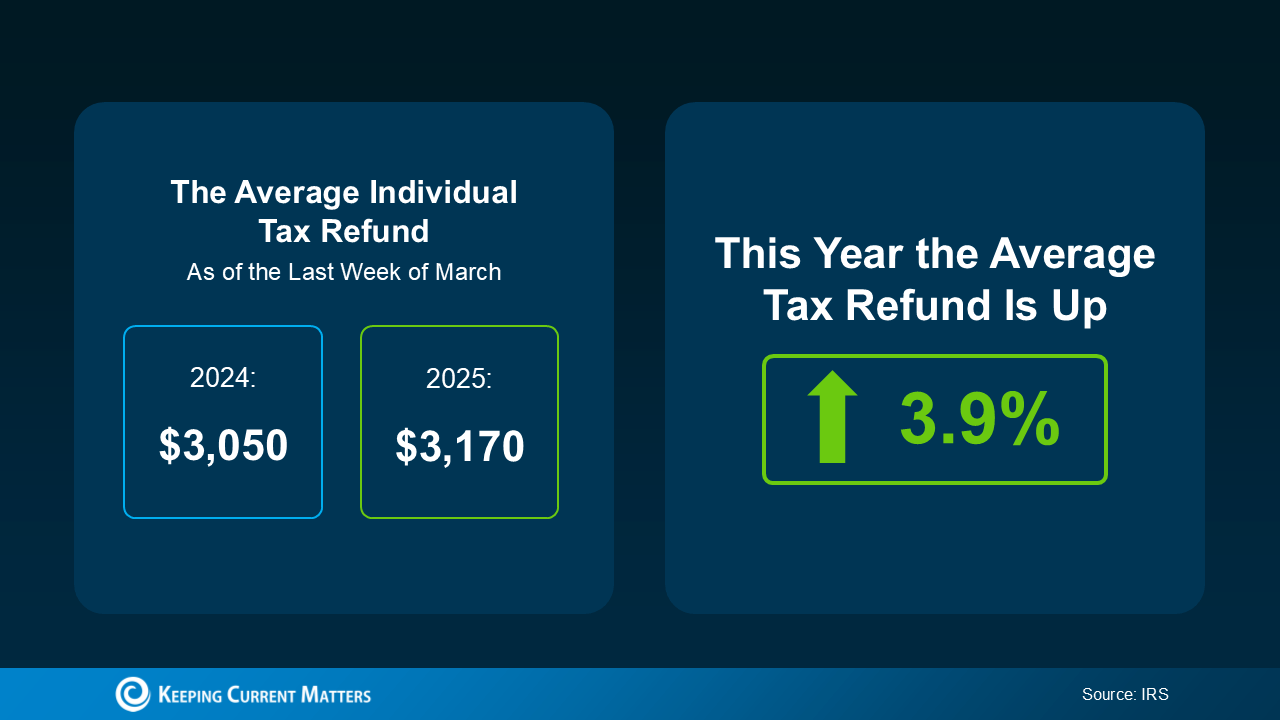

On average, people are getting even more money back in their refunds than they did last year. While it’s not a big increase, the visual below uses data from the Internal Revenue Service (IRS) to show the average individual’s refund is 3.9% higher this year:

Of course, how much money you may get in your tax refund is going to vary. But when it comes to buying a home, any extra cash can help move things forward. Here are a few examples of how you can put that money to good use, according to Freddie Mac:

- Save for a down payment – Saving for a down payment can be one of the biggest hurdles for buyers. Setting aside your tax refund for this expense could help you get to your goal faster. Just remember, it’s typically not required to put 20% down.

- Pay for closing costs – Closing costs include fees for things like the appraisal, title insurance, and underwriting of your loan. They’re generally between 2% and 5% of the total purchase price of the home. So, putting your refund toward these costs can make things more manageable on closing day.

- Lower your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If you qualify for this option, you could pay up front to have a lower rate on your mortgage. If affordability is tight for you at today’s rates and home prices, this may be worth exploring.

But you don’t have to figure it all out on your own. Working with Stovall Team-your trusted real estate professional who understands the homebuying process, what you need to save, and any resources you can tap into will help you make sure you’re ready to buy when the time comes.

Bottom Line

When it comes to saving for a home, every dollar gets you one step closer to your goal. While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost. Ready to make your move? Call me 714.343.9294 or [email protected]

Spring Has Sprung! Are You Considering Selling Your Home?

According to Realtor.com, the best week to list your house this year was April 13-19. And since that week has come and gone, you might be wondering: did I miss my chance? Not at all – and here’s why.

That’s just one source’s take, based on their own research. Other organizations run similar studies. And since different places use different methodologies for their research, sometimes the results vary too – and that’s actually good news for you. According to Zillow, the best time to list your house is still ahead.

The latest research from Zillow says sellers who list their homes in late May tend to see higher sale prices based on home sales from last year. The study explains why:

And they’re not the only ones saying selling in May can help homeowners net top dollar. ATTOM Data conducted a similar study by analyzing 59 million home sales over the past 13 years:

An article from Bankrate echoes this sentiment and brings this all together to show that any time in April or May is a good time:

The window to sell during prime time is very much still open, so you can make a move and potentially cash in big if you sell now.

That said, the best week to list your house really depends on a few local factors, like buyer demand, how many homes are for sale nearby, and how quickly things are selling. That’s why working with an experienced agent who knows your area is key.

Bottom Line

Historically, spring is the busiest time in real estate – and there’s still time to take full advantage of that momentum.

What’s holding you back from making your move this spring? And what would help you feel ready? Let’s connect 714.343.9294