It may seem hard to imagine that the home you’re in today – whether it’s your starter home or just one you’ve fallen in love with along the way – might not be your forever home.

Many needs have changed in 2020, and it’s okay to admit if your house no longer fits your lifestyle. If you’re now working remotely, facilitating virtual school, trying to exercise at home, or simply just spending more time in your own four walls, you may be bursting at the seams in your current house.

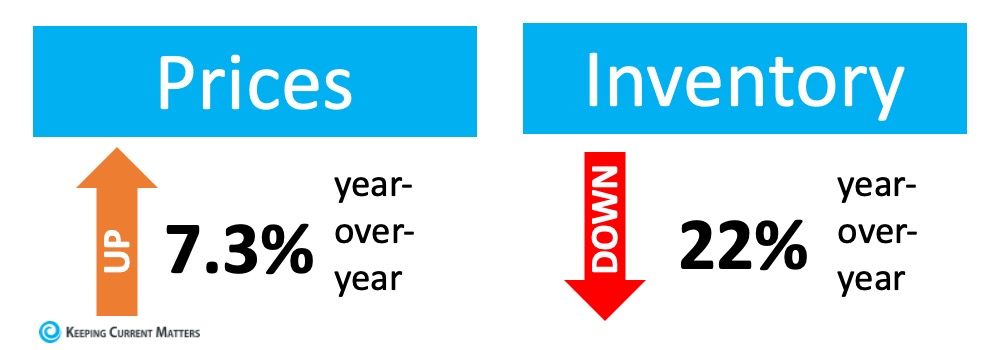

According to the latest Home Price Insights from CoreLogic, prices have appreciated 7.3% year-over-year. At the same time, the National Association of Realtors (NAR) reports that inventory has dropped 22% from one year ago. These two statistics are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

These two statistics are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

This is great news if you own a home and you’re thinking about selling. The equity in your house has likely risen as prices have increased. Even better is the fact that there’s a large pool of buyers out there searching for the American dream, and your home may be high on their wish list.

If you think you’ve outgrown your current home, reach out to Stovall Team today to discuss local market conditions and determine if now is the best time for you to sell. Call me at 714.343.9294

What Does 2021 Have in Store for Home Values?

According to the latest CoreLogic Home Price Insights Report, nationwide home values increased by 8.2% over the last twelve months. The dramatic rise was brought about as the inventory of homes for sale reached historic lows at the same time buyer demand was buoyed by record-low mortgage rates. As CoreLogic explained:

Where will home values go in 2021?

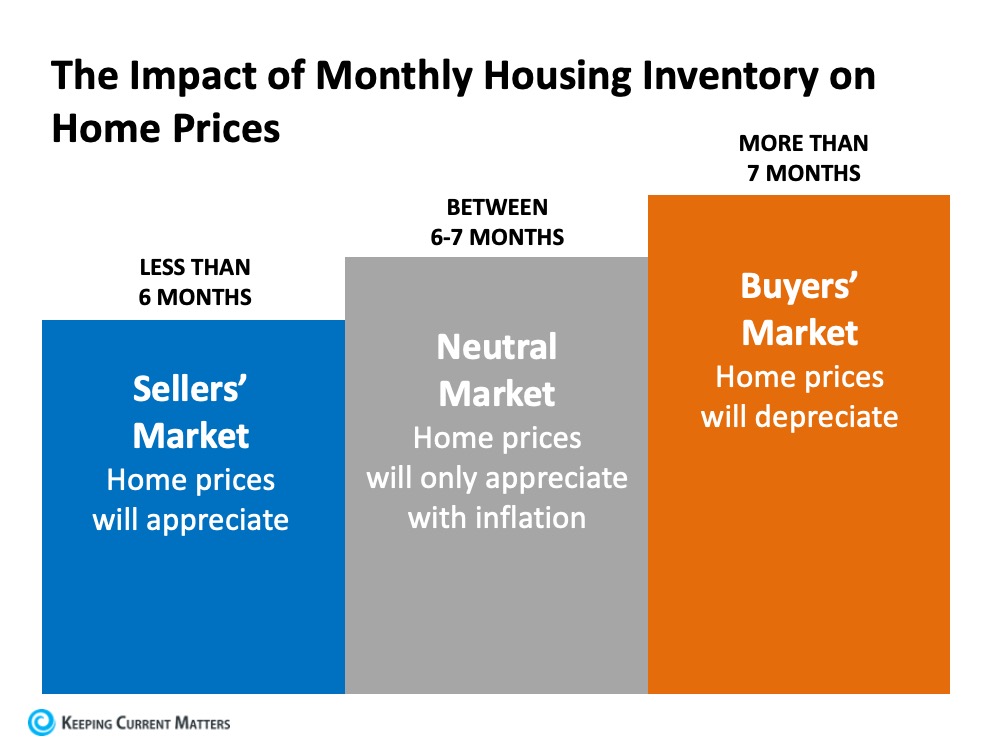

Home price appreciation in 2021 will continue to be determined by this imbalance of supply and demand. If supply remains low and demand is high, prices will continue to increase.

Housing Supply

According to the National Association of Realtors (NAR), the current number of single-family homes for sale is 1,080,000. At the same time last year, that number stood at 1,450,000. We are entering 2021 with approximately 370,000 fewer homes for sale than there were one year ago.

However, there is some speculation that the inventory crush will ease somewhat as we move through the new year for two reasons:

1. As the health crisis eases, more homeowners will be comfortable putting their houses on the market.

2. Some households impacted financially by the pandemic will be forced to sell.

Housing Demand

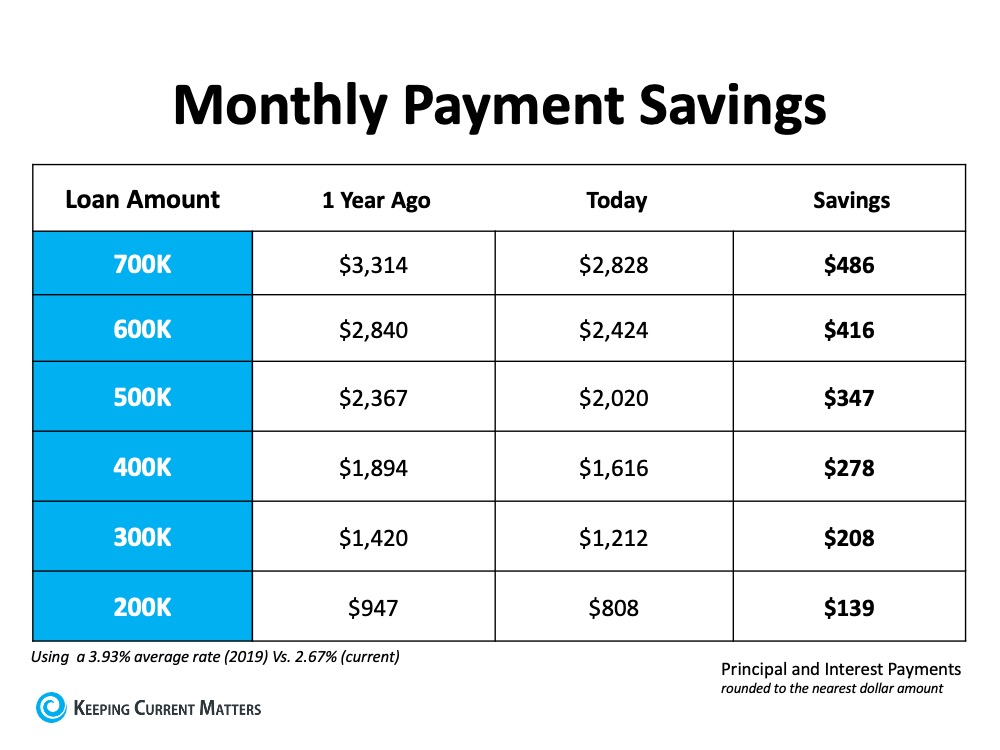

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. Today, we’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year.

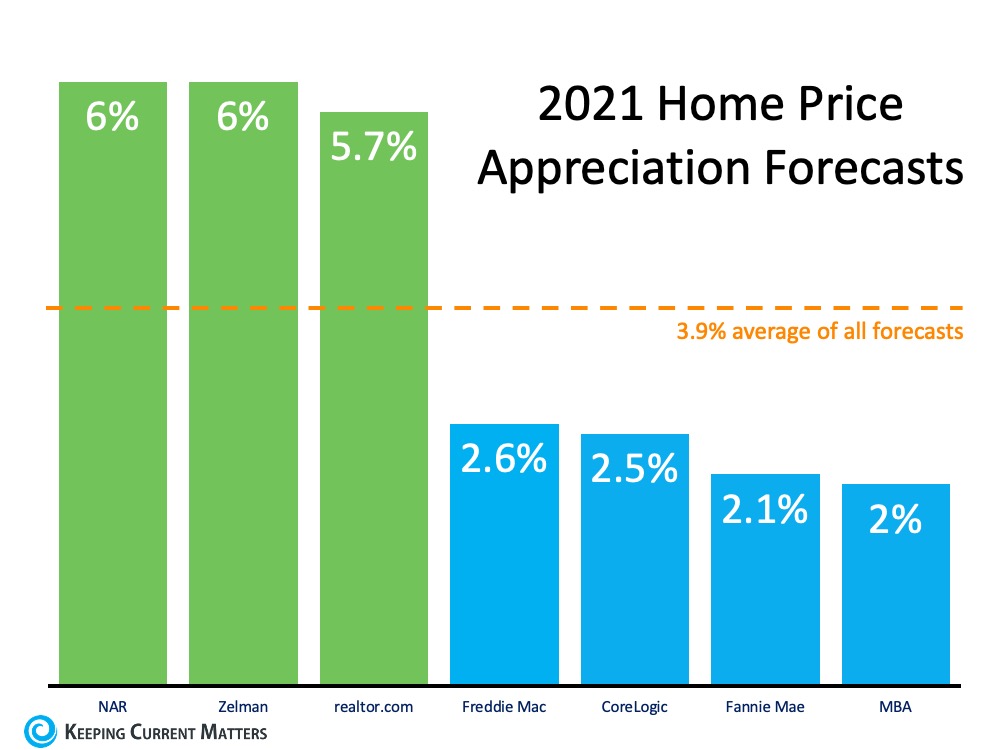

Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

Bottom Line

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate.