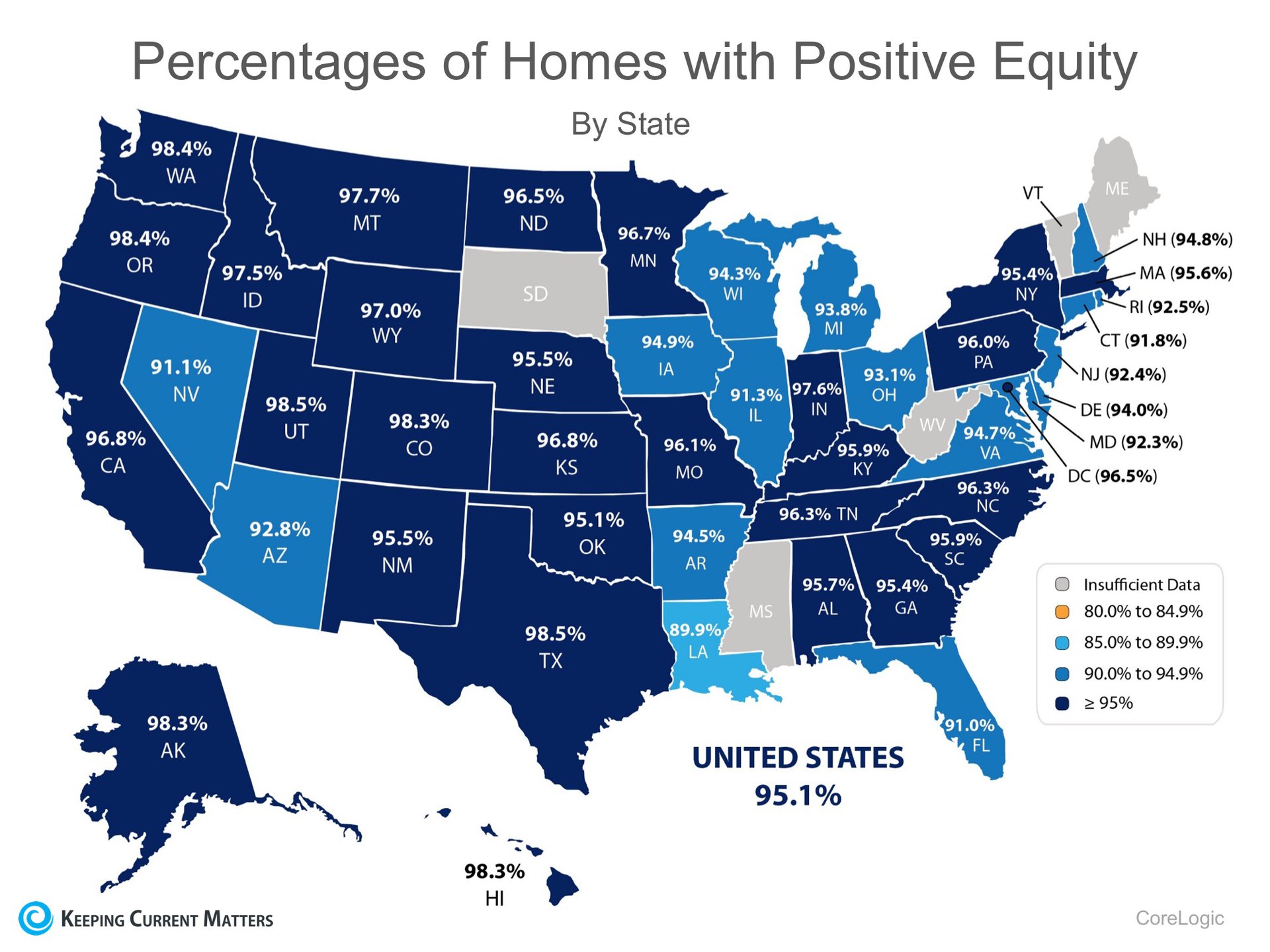

CoreLogic’s latest Equity Report revealed that “over the past 12 months, 712,000 borrowers moved into positive equity.” This is great news, as the share of homeowners with negative equity (those who owe more than their home is worth), has dropped more than 20% since the peak in Q4 of 2009 (26%) to 4.9% today.

The report also revealed:

- The average homeowner gained approximately $14,900 in equity during the past year.

- Compared to Q3 2016, negative equity decreased 22% from 3.2 million homes, or 6.3% of all mortgaged properties.

- U.S. homeowners with mortgages (roughly 63% of all homeowners) have seen their equity increase by a total of $870.6 billion since Q3 2016, an increase of 11.8%, year-over-year.

The map below shows the percentage of homes by state with a mortgage and positive equity. (The states in gray have insufficient data to report.)

Significant Equity Is on The Rise

Frank Nothaft, Chief Economist at CoreLogic, believes this is great news for the “housing market.” He went on to say:

“Homeowner equity increased by almost $871 billion over the last 12 months, the largest increase in more than three years. This increase is primarily a reflection of rising home prices, which drives up home values, leading to an increase in home equity positions and supporting consumer spending.”

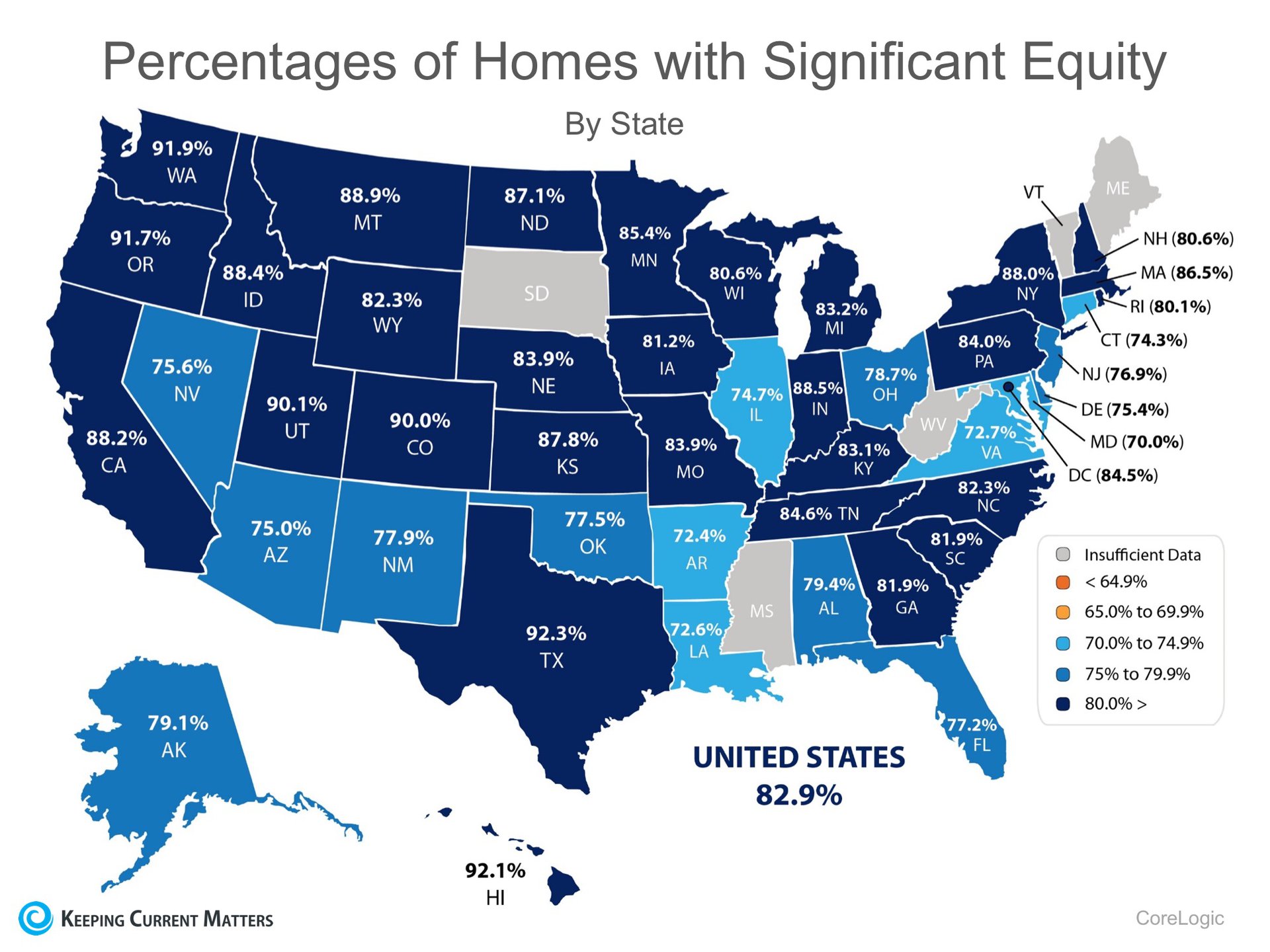

Of the 95.1% of homeowners with positive equity in the U.S., 82.9% have significant equity (defined as more than 20%). This means that more than three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home now.

The map below shows the percentage of homes by state with a mortgage and significant equity.

Bottom Line

If you are one of the many homeowners who are unsure of how much equity you have in your home and are curious about your ability to move, meet with the Stovall Team today! We can help evaluate your situation.

Where Are Mortgage Interest Rates Headed In 2018?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next 12 months.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 7.0% from this time last year and are predicted to be 4.2% higher next year.

If both the predictions of home price and interest rate increases become reality, families would wind up paying considerably more for their next home.

Even a small increase in interest rate can impact your family’s wealth. Meet with Stovall Team today to evaluate your ability to purchase your dream home. CALL TODAY 714.343.9294 and VISIT StovallTeam.com!!