Here’s something you need to know. The housing market is getting back to a healthier, more normal place. And even though it may not sound like it, this shift is actually a good thing.

It’s what you should expect. It’s just that our expectations have been skewed by the intense seller’s market over the past few years.

But what you need to remember is: there’s still plenty of opportunity to be had if you’re thinking about selling – whether that’s next month or next year. You just need to stay up to date on what’s happening in the market, and have a strategy that matches the moment. Here’s your update.

1. Inventory’s Up. Buyer Power Is Coming Back.

According to the latest data, the number of homes for sale is rising back toward more normal levels (see graph below):

But inventory growth is going to vary a lot based on where you live.

If you’re in a market where the number of homes for sale is back to normal, buyers may have more sway than you’d expect. That doesn’t mean buyers have all the power – it just means they have more choices, so your home has to stand out.

But if you live where inventory is still pretty limited, you may see more buyers competing for your house.

No matter where you are, the key is to work with a pro who can help you adjust your game plan for your local market.

2. The Right Price Matters More Than Ever

With more homes to choose from, today’s buyers are quick to skip over homes that feel overpriced. That’s why pricing your house right is the secret to selling quickly and for top dollar. That’s a point Realtor.com really drives home:

“ . . . a seller listing a well-priced, move-in ready home should have little problem finding a buyer.”

Miss the mark, though, and you may have to backtrack. Today, about 1 in 5 sellers (19.1%) are reducing their asking price to attract buyers

Here’s how to avoid being one of those sellers who has to reduce their asking price. Danielle Hale, Chief Economist at Realtor.com, says:

“The rising share of price reductions suggests that a lot of sellers are anchored to prices that aren’t realistic in today’s housing market. Today’s sellers would be wise to listen to feedback they are getting from the market.”

The best way to get that information? Lean on your local agent. They have the expertise to set a price that sells in any market. Because if your price isn’t compelling, it’s not selling.

3. Flexibility Wins Negotiations

Gone are the days of buyers waiving inspections and appraisals just to get a deal done. Now, because they have more homes to choose from, buyers are able to ask for things like repairs, credits, and help with closing costs. And data from Redfin shows nearly 44.4% of sellers are willing to negotiate (see graph below):

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

And it’ll help if you think of concessions as tools, not losses. Use them to bridge gaps, sweeten deals, and get across the finish line. And don’t stress. Since prices went up roughly 55% over the past five years, you’ve got plenty of room to make a concession or two and still come out ahead.

Just be sure to work with your agent to understand which concessions could be the key to sealing the deal.

Bottom Line

Sellers who are going to succeed in the weeks and months ahead are the ones who understand this market shift and lean into it with the right expectations and the right strategy.

Connect with Stovall Team today 714.343.9294 and talk about what’s working in your area right now – and how to make those wins work for you, too – whenever you’re ready to make a move.

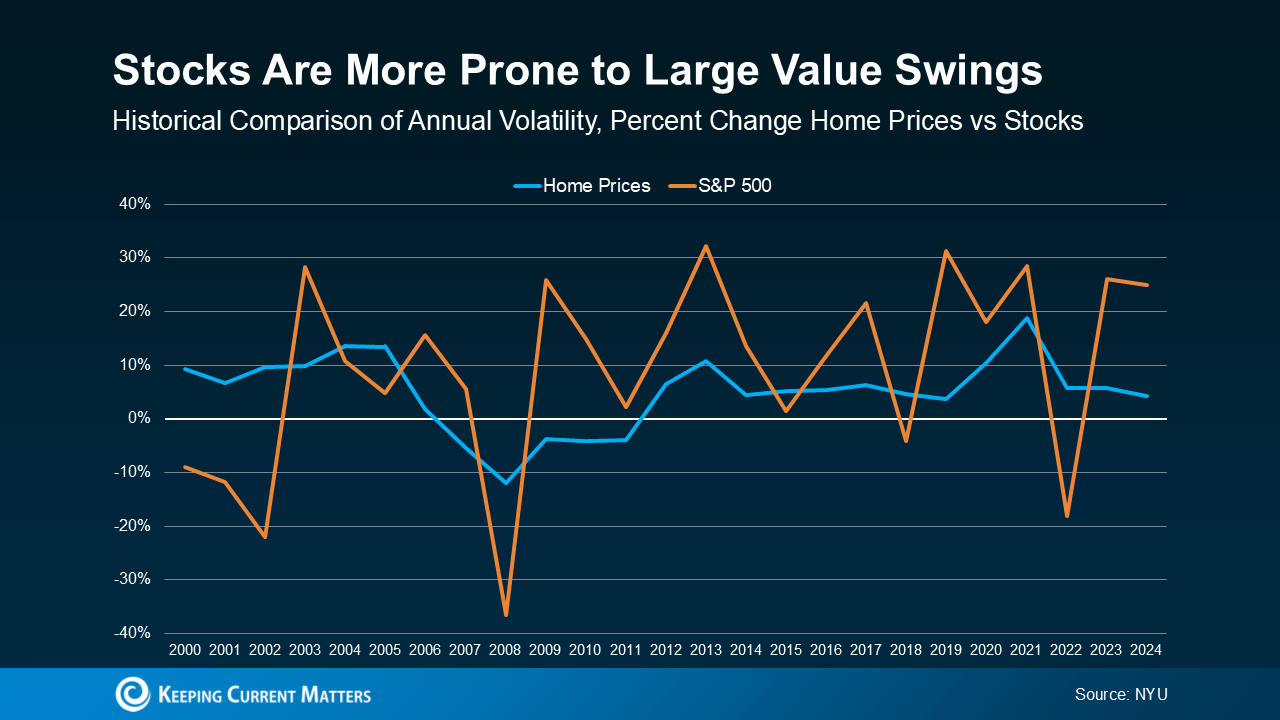

3 Reasons To Buy a Home This Summer

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize:

This summer might actually be the best time to buy in years. Here are three big reasons why.

1. You Have More Negotiating Power

After several years of sellers having all the leverage, things are starting to shift. Check out the graph below. It uses data from Redfin to show that right now, there are more sellers active in the market than buyers:

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Now, the market has shifted, and buyers are regaining their negotiating power as a result. With more sellers than buyers, sellers may be more willing to pay for repairs, cover some of your closing costs, or lower their asking price. The return of this kind of normal balance is a sign of a much healthier, more sustainable market. As Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), explains:

And just in case you’re worried there are too many homes on the market, here’s what you should know. Overall inventory is still lower than normal, so you don’t have to worry about a nationwide oversupply or a crash.

2. You Have More Choices

The number of homes for sale has improved a lot. Based on the latest data from Realtor.com, more homes were listed this May than in May 2024 or May 2023 (see graph below):

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

3. You May See More Flexibility on Price

With more homes for sale, they’re not selling at the same frenzied pace they were just a few years ago.

Since homes are taking more time to sell, some sellers are choosing to lower their asking prices to draw buyers back in or speed up the process. And that’s to-be-expected. According to Realtor.com, 19.1% of listings had a price cut this May (see graph below):

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

While you shouldn’t expect a big discount, you may find sellers are a bit more flexible right now. As a recent article from The Street says:

Just remember, most sellers still aren’t adjusting their prices – just the ones who overpriced to start with. So, this isn’t a sign of a crash, it’s a sign of some sellers having outdated expectations in a shifting market.

Bottom Line

This summer brings a powerful combo for buyers: more homes to choose from, less competition, and sellers being more flexible on pricing. If you’re ready to make a move, connect with Stovall Team today 714.343.9294. We’d love to help you take the next step.

What would finding the right home this summer mean for your next chapter?