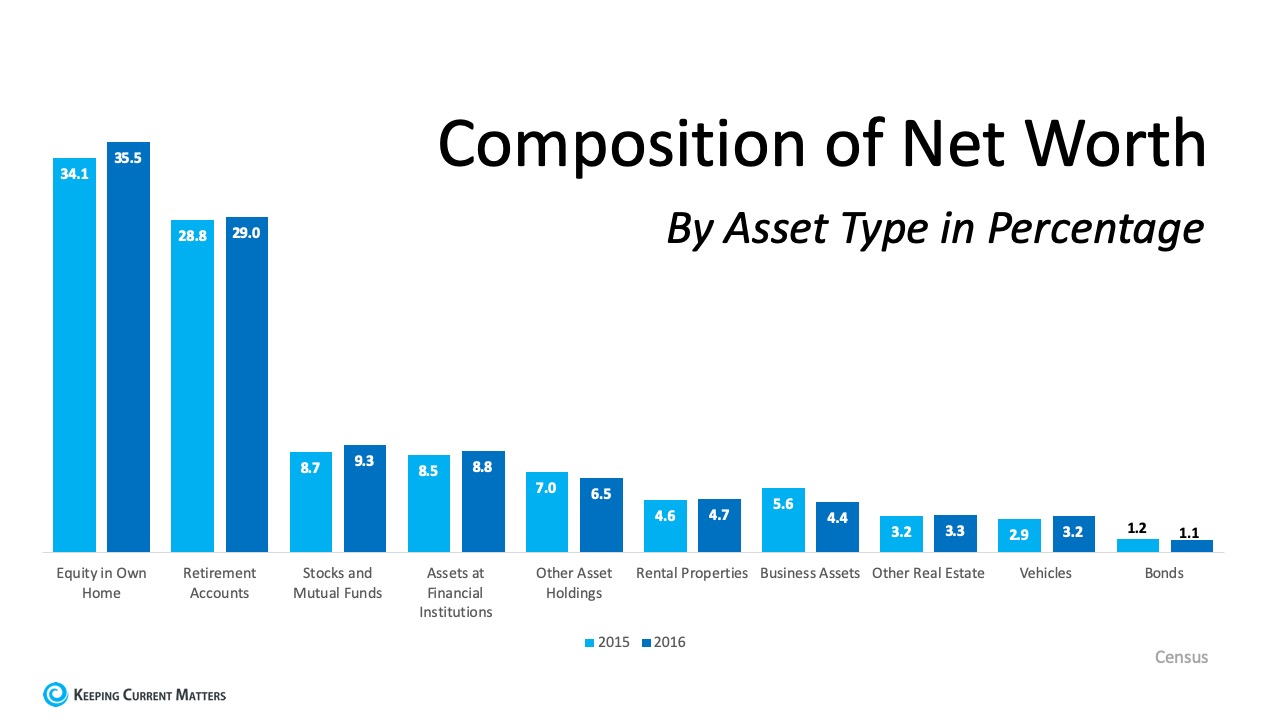

Many people plan to build their net worth by buying CDs or stocks, or just having a savings account. Recently, however, Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the U.S. Census Bureau, shared the biggest determinants of wealth,

“The biggest determinants of household wealth [are] owning a home and having a retirement account.” (Shown in the graph below):

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

“Net worth is an important indicator of economic well-being and provides insights into a household’s economic health.”

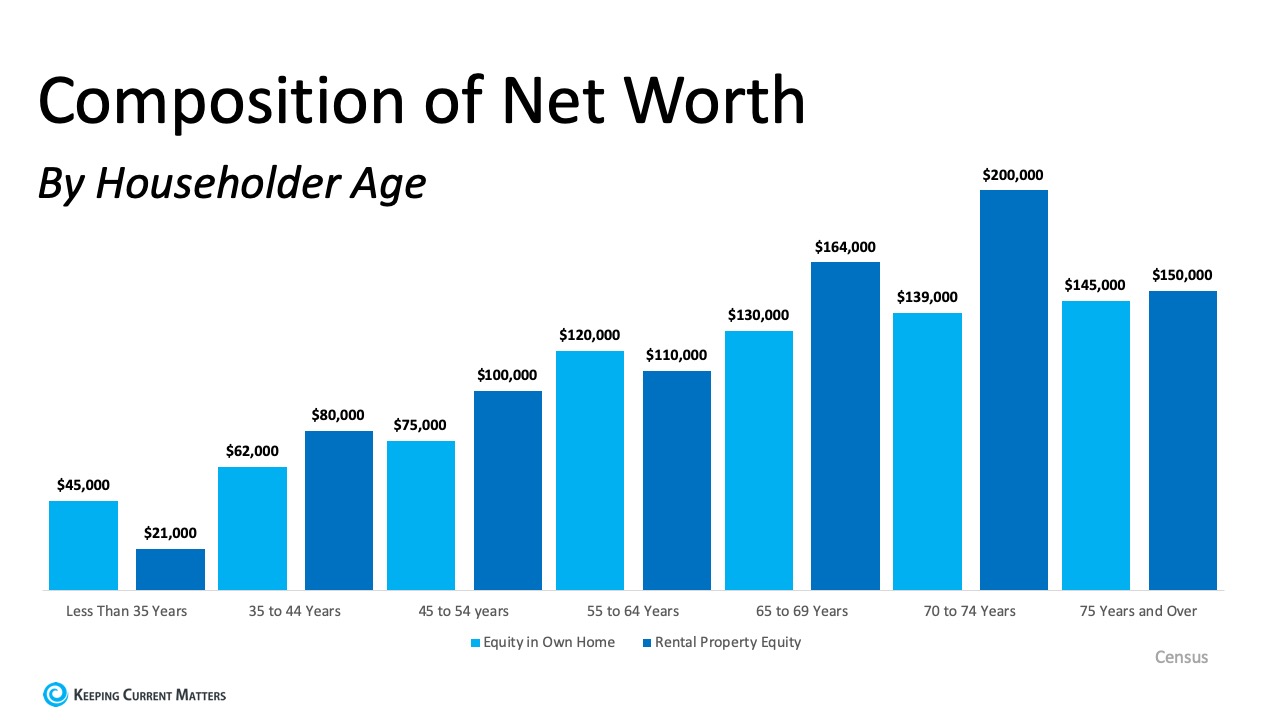

Having equity in your home can help your family move in that direction, building toward substantial financial growth. According to the report noted above, people are not only creating net worth in the homes they live in, but many are also earning equity in rental property investments too. (See below): John Paulson said it well,

John Paulson said it well,

“If you don’t own a home, buy one. If you own one home, buy another one, and if you own two homes buy a third and lend your relatives the money to buy a home.”

Bottom Line

There are financial and non-financial benefits to owning a home. If you would like to increase your net worth, meet with Stovall Team to help you understand all the benefits of becoming a homeowner. Call 714.343.9294 or visit stovallteam.com

3 Reasons to Use a Stovall Team in a Complex Digital World

If you’re searching for a home online, you’re not alone; lots of people are doing it. The question is, are you using all of your available resources, and are you using them wisely? Here’s why the Internet is a great place to start the home-buying process, and the truth on why it should never be your only go-to resource when it comes to making such an important decision.

According to the National Association of Realtors (NAR), the three most popular information sources home buyers use in the home search are:

Clearly, you’re not alone if you’re starting your search online; 93% of home buyers are right there with you. The even better news: 86% of buyers are also getting their information from a real estate agent at the same time.

Here are 3 top reasons why using Micah Stovall and Stovall Team in addition to a digital search is key:

1. There’s More to Real Estate Than Finding a Home Online. It’s a lonely and complicated trek around the web if you don’t have a real estate professional to also help you through the 230 possible steps you’ll face as you navigate through a real estate transaction. That’s a pretty staggering number! Determining your price, submitting an offer, and successful negotiation are just a few of these key steps in the sequence. You’ll definitely want someone who has been there before to help you through it.

2. You Need a Skilled Negotiator. In today’s market, hiring a talented negotiator could save you thousands, maybe even tens of thousands of dollars. From the original offer to the appraisal and the inspection, many of the intricate steps can get complicated and confusing. You need someone who can keep the deal together until it closes.

3. It Is Crucial to Make a Competitive and Compelling Offer. There is so much information out there in the news and on the Internet about home sales, prices, and mortgage rates. How do you know what’s specifically going on in your area? How do you know what to offer on your dream home without paying too much or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

Hiring a real estate professional who has his or her finger on the pulse of the market will make your buying experience an informed and educated one. You need someone who is going to tell you the truth, not just what they think you want to hear. If you’re ready to start your search online, you’ll need an educated and informed real estate professional like Micah Stovall. You’ll want someone at your side who can answer your questions and guide you through a process that can be complex and confusing. As your Realtors, we are living the market daily. I see between 5-50 homes every single week-approximately 1,100 homes per year. I can help you maximize your investment, even if you are not planning to sell anytime soon. Locally, inventory is low, meaning there is less than the 6-month housing supply needed for a normal market. This drives buyer demand, creating a perfect time to sell. If you’re considering selling your house, we should sit down and chat and help you confidently determine what will be the best choice for you and your family. Call me today at 714.343.9294.